Berkshire Hathaway Reports Record Earnings Surge and Cash Pile

In a major financial update, Berkshire Hathaway led by the leading investor Warren Buffett, exposed an extraordinary increase in operating income during the fourth quarter of the financial year. The famous group for its diverse investment in various fields saw a surprise increase of 28% in operating income for the quarter that ended in December, which is a total of $8.481 billion. This strong performance indicates a considerable increase from $6.625 billion recorded in the same period of last year.

The impressive development speed was not limited to just one quarter, as the operating income of Berkshire Hathaway for the entire financial year 2023 increased to $37.350 billion, which shows a significant increase of 17% compared to the earnings of $30.853 billion last year.

One of the prominent cooperators in Berkshire Hathaway’s financial success was his insurance business, which took significant advantage. Under Geico, Berkshire umbrella, a prominent auto insurance company reported a profitable year with net underwriting revenue of $5.428 billion in 2023. The reason for this success was a decline in strategic premium rate adjustment and claims.

However, all fields within the Berkshire Hathaway did not experience the same development. Burlington Northern Santa Fay (BNSF), which is its railroad institution, reported a 14% reduction in net income of the year, which ran from $5.087 billion to $5.087 billion in the last year.

Despite the challenges related to certain sectors, the overall financial position of Berkshire Hathaway significantly strengthened. The party’s cash reserves reached a record break in the fourth quarter of $167.6 billion, which left behind $157.2 billion of the previous quarter. This remarkable pile of cash illustrates the strong financial status of Berkshire Hathaway and the ability to benefit from investment opportunities in the market.

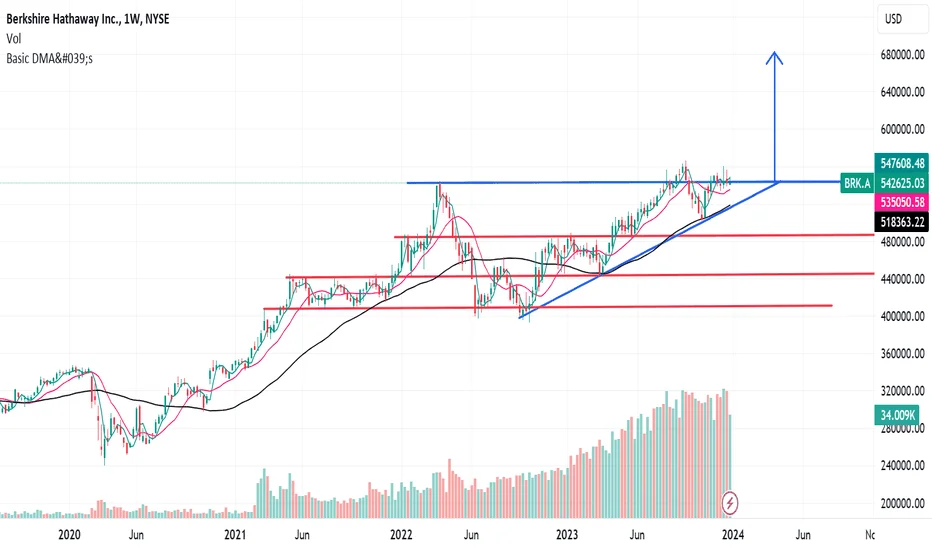

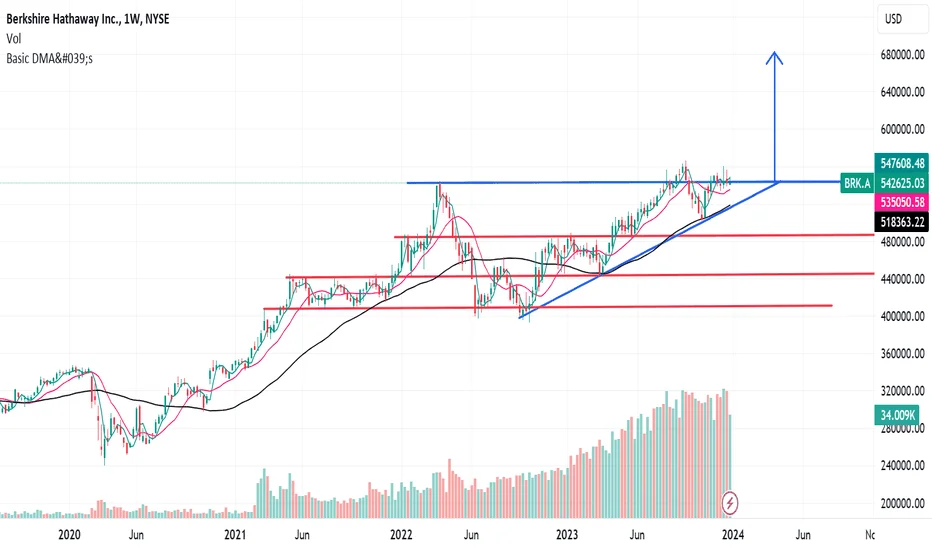

Furthermore, shares of Berkshire Class A demonstrated flexibility, roughly 16% from years to date, and expressed the trust of investors in the company’s performance and future prospects.

Warren Buffett, the legendary investor, and chairman of Berkshire Hathaway, is expected to provide shares with more insights about the company’s financial strategy and market perspectives in their upcoming annual letter. This expected letter, soon to be released, will present the shareholders with a valuable approach to economy and investment strategies, Buffet’s first letter was to his long-standing partner, Charlie Monger, who died in November.

Despite the significant financial achievements in Berkshire Hathaway’s revenue report, the party is established on its long-term investment philosophy. In its annual report, Berkshire Hathaway emphasized the importance of focusing on the economic performance of the operating business rather than short-term volatility in investment benefits and disadvantages, strengthening its commitment to creating sustainable development and shareholder value.

Recent financial performance of Berkshire Hathaway:

1. Increase operating income in Q4:

Berkshire Hathaway reported an operating income of $8.481 billion in the fourth quarter. This income includes profit from different fields within the group, including insurance, railroad, and utility. This data indicates a significant increase in profit during this quarter.

2. Constant increase in operating income for the financial year 2023:

During the entire financial year 2023, the operating income of Berkshire Hathaway saw continuous growth speed. Operating income increased to $37.350 billion for the entire year, which is a significant increase of 17% compared to the earnings of $30.853 billion in the previous financial year. This stable development clarifies the strongest performance of the party in its diverse business portfolio.

3. Record Cash Holdings:

Berkshire Hathaway significantly strengthened its financial reserves during the fourth quarter. The party had a cash of $167.6 billion, which established a new record level of liquidity. This led to the Cash Reserve exceeding $157.2 billion in the past quarter, highlighting the ability to benefit from a strong financial position and potential investment opportunities in Berkshire Hathaway.

Overall, the impressive financial performance of Berkshire Hathaway, feature increases operating earnings and indicates the records more cash reserve, strength, and stability within the party.

Frequently asked questions about the financial performance of Berkshire Hathaway (FAQs)

1. What is operating income, and how does it affect the financial performance of Berkshire Hathaway?

Operating earnings refer to the profit from various business operations of Berkshire Heathway, including insurance, railroad, and utilities. It works as the operational performance of the party and the key indicator of the overall profit.

2. How much did Berkshire Heathway’s operating income increase in the fourth quarter?

Berkshire Hathaway reported an operating income of $8.481 billion in the fourth quarter, which shows a significant increase in profit compared to the previous quarters.

3. What was the operating income rate of Berkshire Heathway for FY 2023?

Berkshire Hathaway’s operating income increased to $37.350 billion in the financial year 2023. This reflects a significant increase of $30.853 billion in the previous financial year.

4. What factors played in increasing the operating income of Berkshire Heathway?

The increase in operating earnings can be attributed to the diverse portfolio of the group business, including insurance, railroad, and successful performance in the Utility sector, other than others.

5. How does Berkshire Hathaway’s record Cash Holdings affect its financial strategy?

The record of Berkshire Heathway’s 167.6 billion dollar Cash Reserve provides the group with substantial liquidity, which enables it to benefit from investment opportunities and navigate various market conditions with financial flexibility.

6. What is the importance of the strong financial performance of Berkshire Hathaway for investors?

Berkshire Hathaway’s strong financial performance shows the ability to generate sustainable profit and create long-term value for shares. Investors can see it as a positive indicator of the party’s stability and future development.

7. How does Berkshire Heathway compare industrial standards and competitors’ financial performance?

Berkshire Hathaway’s financial performance is often compared to industrial standards and competitors of its related fields to estimate its relative strength and competitive position in the market.

8. What role does Warren Buffett in the Financial Decision Making Process of Berkshire Hathaway?

Warren Buffet, as Chairman and one of the most influential investors in the world, plays a vital role in guiding the financial strategy and investment decisions of Berkshire Hathaway, leading the success of the party by taking advantage of his skills and long-term vision.