China’s Retirement Age Dilemma

China’s retirement age policy is undergoing giant changes because the country Seeks to cope with its growing older population, monetary challenges, and pension system stress. With over 264 million citizens aged 60 or older, the authorities face developing strain to modify the retirement age which has remained unchanged for decades.

As of 2024 China’s retirement age remains set at 60 for men 55 for women white collar people and 50 for female blue collar employees. These figures have not been up to date since the early 1950s, given the great changes in life expectancy and the general fitness of the personnel. The growing older populace now strains the nation’s pension system.

China’s average life expectancy has risen dramatically attaining around 78 years. As lifestyle expectancy increases the years people spend in retirement develop longer placing additional strain on the pension budget. The shrinking team of workers a result of China’s low birth rate exacerbates this problem as fewer employees make contributions to the pension system while the number of retirees grows.

China’s pension system operates on a “pay as you go” foundation where modern day workers fund the pensions of retirees. With the growing ratio of retirees to operating age people the pension fund dangers are running deficits. A revision of the retirement age is visible as an essential step to sustain the pension system ultimately.

The Chinese government is thinking about a phased method to raise the retirement age. The proposed adjustments include progressively increasing the retirement age over the next numerous years to ease the transition for workers and groups alike.

Rather than a surprising exchange the Chinese authorities plan to enforce a gradual increase in the retirement age with a preliminary consciousness on elevating the age by means of a few months each year. This approach’s objectives are to minimize disruptions to the labor market and allow both businesses and employees to regulate.

One of the crucial regions of focus in the reform is addressing the gender disparity in retirement age. Ladies, particularly blue collar workers are required to retire in advance than men. The reform seeks to align the retirement age throughout genders selling equality within the staff and increasing women’s participation in the financial system.

Raising the retirement age has accomplished outcomes for China’s economic system. These changes will affect worker supply productivity purchaser spending and healthcare expenses.

Extending the operating lifestyles of individuals could assist mitigate the declining workforce due to the country’s aging population. A large and more skilled staff should make a contribution to improved productivity assisting to sustain a financial boom. As more people continue to be hired longer this would additionally reduce the strain on social security structures.

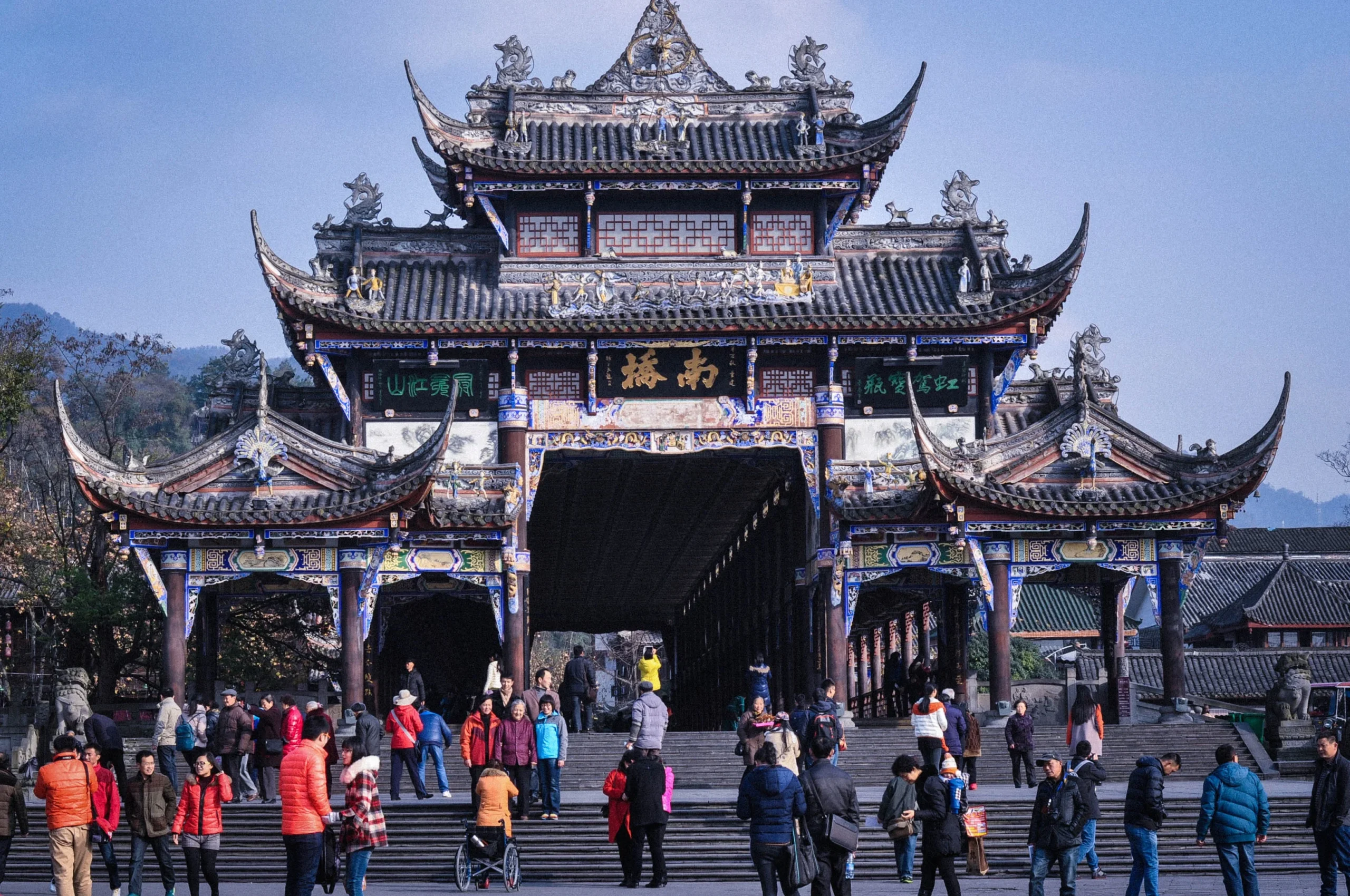

Older people generally tend to have better earnings and more disposable cash than more youthful workers. By preserving older people within the personnel for longer the reform could bolster purchaser spending in particular in sectors catering to middle elderly and older adults inclusive of healthcare tourism and financial services.

While keeping older employees in the workforce can provide monetary benefits it additionally provides challenges. The healthcare system can also face accelerated demand as older people require more scientific attention and workplace accommodations. Long term care for the elderly may want to grow to be a large burden if the workforce becomes too elderly without a proper support system in place.

In Chinese culture, family plays an essential function in caring for the aged. The retirement age reform may want to change in adjustments in family dynamics as older individuals stay in the workforce for an extended length potentially delaying the time they have to take care of grandchildren or aged mother and father. This shift may require families to depend extra on institutional care offerings which can be nevertheless underdeveloped in many parts of the country.

The retirement age reform is met with mixed reactions. Many citizens mainly the ones in physically annoying jobs are involved approximately the feasibility of operating beyond their present day retirement age. On the other hand, more youthful generations may additionally welcome the reform as it could ease the burden on them to assist a growing aged population through taxes and pension contributions.

Many Chinese employees mainly in industries requiring physical labor are proof against the idea of delaying retirement. They argue that their health and well being may not allow them to continue operating into their 60s or 70s. This subject is particularly acute for blue collar workers whose jobs often involve heavy manual labor.

Another situation concerning the reform is its capability to exacerbate financial inequality. Wealthier individuals who are somehow in much less physically traumatic roles may additionally discover it less difficult to hold working past the current retirement ageIn contrast lower income workers particularly in rural areas may struggle to meet the demands of their jobs as they age. Addressing these disparities will be critical for the achievement of these reforms.

There are concerns that extending the operating life of older employees should limit activity opportunities for younger people. If older workers continue to be in their positions longer it could sluggish the professional progression of youthful employees leading to frustrations and potentially higher unemployment rates among the youth.

China’s proposed retirement age reform represents an essential adjustment to cope with the demographic demanding situations of a growing old population. By progressively increasing the retirement age the government aims to alleviate the stress on the pension system and sell sustained financial increase. The achievement of this reform will depend upon addressing the worries of employees managing monetary inequalities and making sure that the healthcare and social protection systems are equipped to support an older workforce.