GE Shatters Wall Street Predictions in Epic Q4 Report

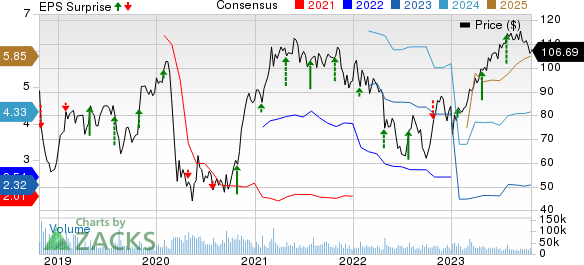

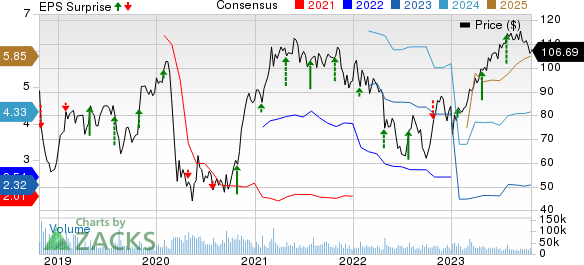

General Electric (GE) has outperformed marketplace expectancies in its recently released fourth-quarter earnings report, signaling an essential second for the 130-yr-vintage commercial giant. The employer reported adjusted profits in keeping with a percentage (EPS) of $1.03 from sales totaling $18.Five billion, surpassing Wall Street estimates of ninety cents EPS and $17.2 billion in income. This achievement comes amid GE’s drawing close break up into two wonderful entities inside the first 1/2 of 2024.

Looking ahead, GE’s guidance for 2024 introduces a brand new dynamic as it prepares to divide its operations into GE Vernova, which specializes in strength generation, and GE Aerospace, focusing on aviation-associated corporations. The expected break up is expected to occur early in the second quarter, with GE projecting first-region sales and income for the combined employer, looking ahead to EPS between 60 and 65 cents and high single-digit sales growth.

Despite the EPS guidance falling below Wall Street estimates, GE’s solid sales forecast for the first quarter aligns with the historical trend of the initial quarter being the slowest business quarter of the year. The full-year outlook includes free cash flow projections for both entities, with Vernova expected to generate approximately $900 million and GE Aerospace aiming for “greater than $5 billion,” exceeding Wall Street’s pre-split estimate of $6.3 billion for 2024.

As GE navigates these changes, investors are closely monitoring the company’s strategic moves. The impending split, set to occur in April, marks a pivotal moment for GE, leaving only GE Aerospace as the last remaining piece of the once-consolidated company.

Analysts anticipate that GE’s 2024 guidance, set to be disclosed alongside the fourth-quarter figures, may require additional effort to interpret due to the complex timing and ongoing restructuring. The company may provide guidance for the consolidated entity, individual guidance for GE Vernova and GE Aerospace, or opt to delay comprehensive guidance until early March when both entities host investor days ahead of the spinoff.

Sheila Kahyaoglu, an analyst at Jefferies, predicts a “beat and raise” quarter, expecting profit margin expansion for the aerospace division and a turnaround for Vernova, potentially accelerating its operating profit. Despite the challenges faced by Vernova, including a money-losing wind power division, Kahyaoglu rates GE shares as Buy, with a $150 price target.

As GE shares hold to outperform, gaining 64% over the last three hundred and sixty-five days, buyers look ahead to the capability effect of the fourth-zone outcomes on the corporation’s trajectory. With the approaching breakup, this income record could be the last consolidated replacement before GE Aerospace and GE Vernova document one after the other in the future.

GE’s fourth-quarter performance demonstrates resilience amid transformative changes, setting the stage for a dynamic 2024 and beyond.