China’s Economic Slowdown Triggers Market Chaos!

As the sun rose over the financial hubs of Europe, a sense of unease enveloped trading floors in response to China’s recent economic data, which fell short of expectations. Investors, akin to seasoned sailors adjusting their sails to read the market winds, swiftly shifted into a risk-off mode, seeking refuge in safer assets and dampening market optimism.

The Impact on European Markets

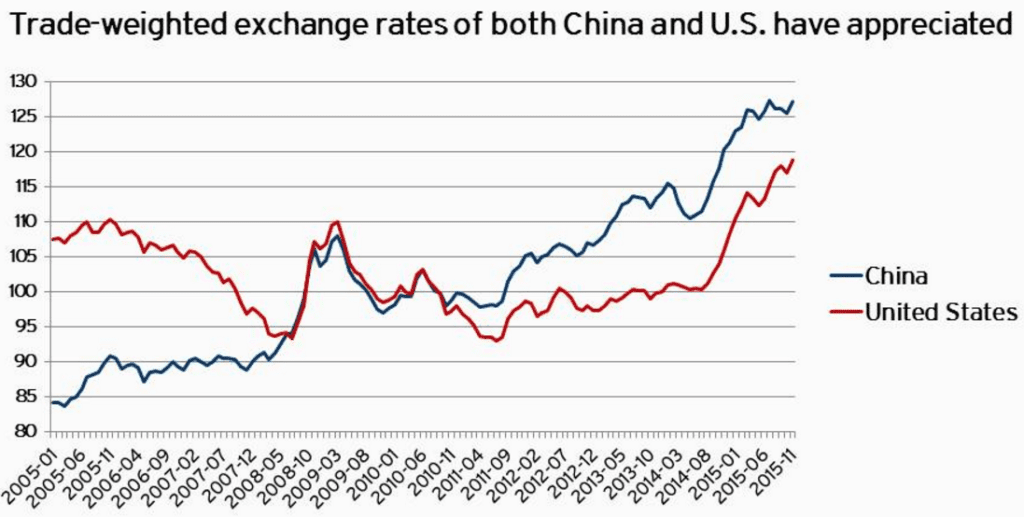

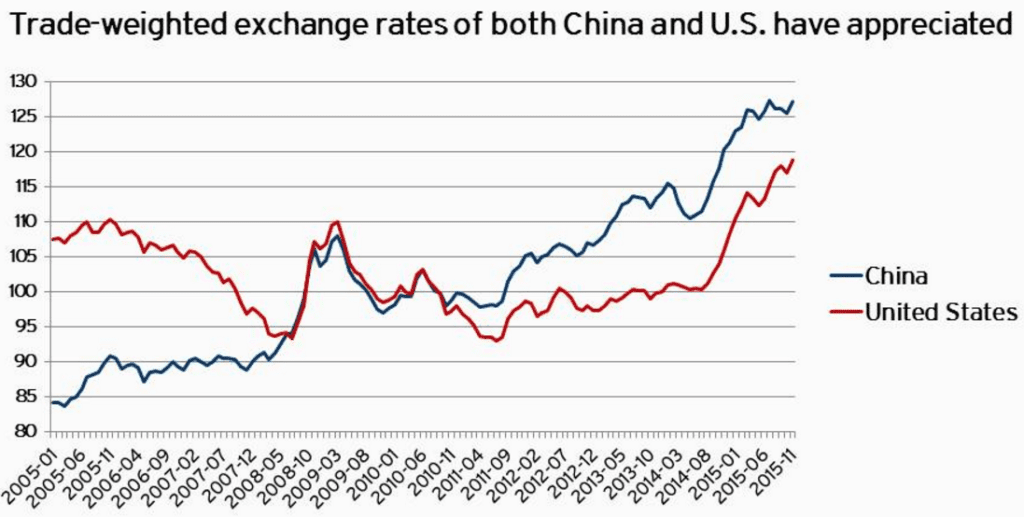

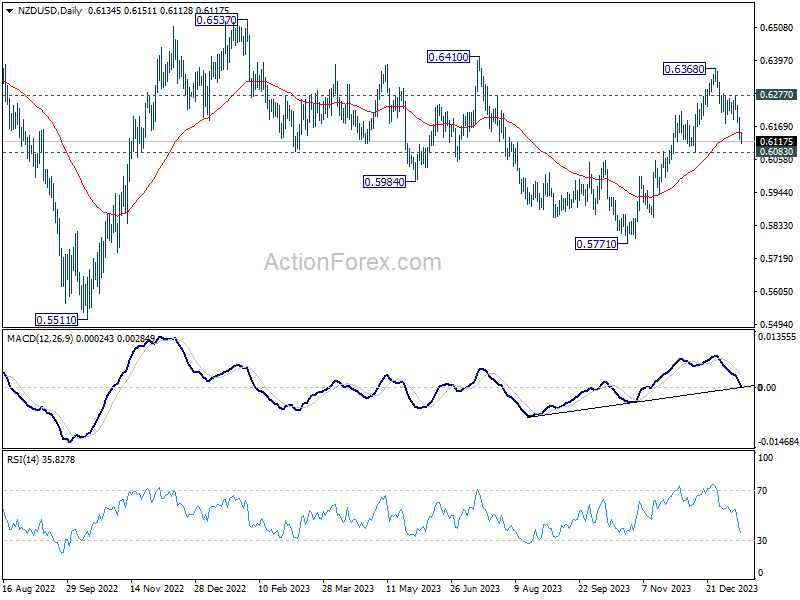

The reverberations of China’s economic figures were felt across diverse asset classes. Stock prices stumbled, bond yields dipped, and currency exchange rates experienced notable fluctuations. While the data was specific to China, the interconnected nature of global financial markets became evident as the unease spread throughout Europe.

China’s Economic Slowdown: Its Gravity

When China’s economic data revealed the nation’s worst growth in more than thirty years, world markets shuddered. China is a major actor in world economic growth and has a significant influence on international commerce and the commodities sectors. This slowdown’s effects may be seen globally, which would raise questions about China’s geopolitical limits.

Getting Ahead in Uncertain Seas

Investors find themselves on high alert, closely monitoring the situation and evaluating its potential impact on the broader economic landscape. While calls for stimulus measures to spur growth echo through the financial corridors, early expectations of an interest rate cut are waning. The unfolding narrative of global economics may well hinge on how China manages to navigate through these uncertain waters, emphasizing the critical role economic indicators play in shaping investor behavior.

Market Trends Amid Chinese Data

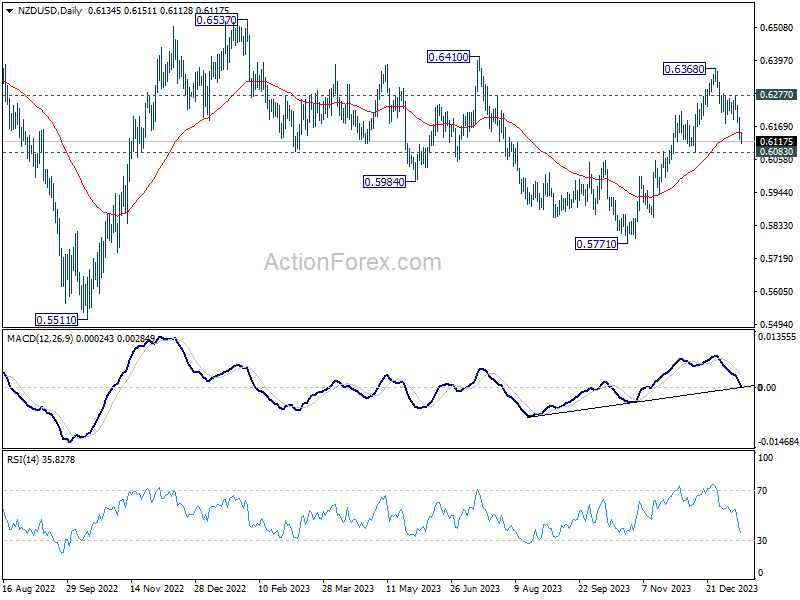

Hong Kong stocks led the region’s fall due to China’s economic issues, reflecting investor dissatisfaction. Given the prevailing risk sentiment, the dollar emerged as the best performer for the week. Reports hint at an “extreme scenario” where major central banks may refrain from interest rate cuts this year, challenging market expectations. Australian and New Zealand Dollars faced pressure due to their economic ties with China, while the Japanese Yen weakened. The Canadian Dollar and Euro displayed resilience, with the Pound and Swiss francs showing mixed performances.

Central Bank Perspectives

Federal Reserve Governor Christopher Waller anticipates potential rate cuts in the face of growing confidence in achieving inflation targets. However, he emphasizes the importance of upcoming CPI revisions and data in shaping policy decisions. In contrast, ECB Governing Council members Gediminas Simkus and Madis Müller urge caution over aggressive rate cut expectations, emphasizing the need for data alignment with market projections.

China’s Economic Snapshot

China’s Q4 GDP growth reached 5.2%, showing a slight uptick from the previous quarter. Industrial production rose, but retail sales growth decelerated, signaling deeper economic challenges. Investment patterns exhibited a mixed trend, with real estate investment dropping significantly. China’s population declined for the second consecutive year, posing a demographic challenge.

Looking Ahead

The focus shifts to the UK CPI data in the European session, while the Eurozone will release CPI final figures. In the US, retail sales will draw attention, alongside import prices, industrial production, business inventories, and the NAHB housing index. The Fed’s Beige Book economic report will provide further insights into the global economic landscape.