Financial Turmoil for New York Community Bancorp: Moody’s Downgrades to Junk

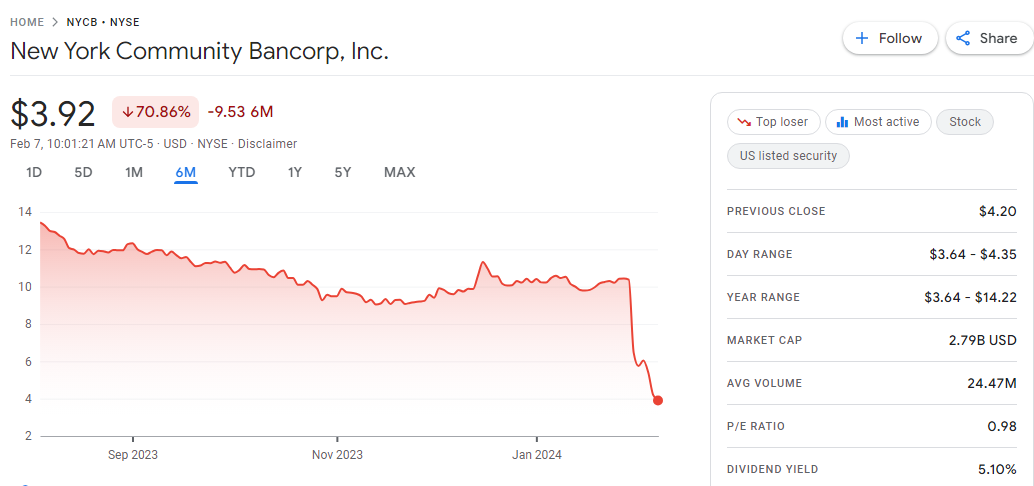

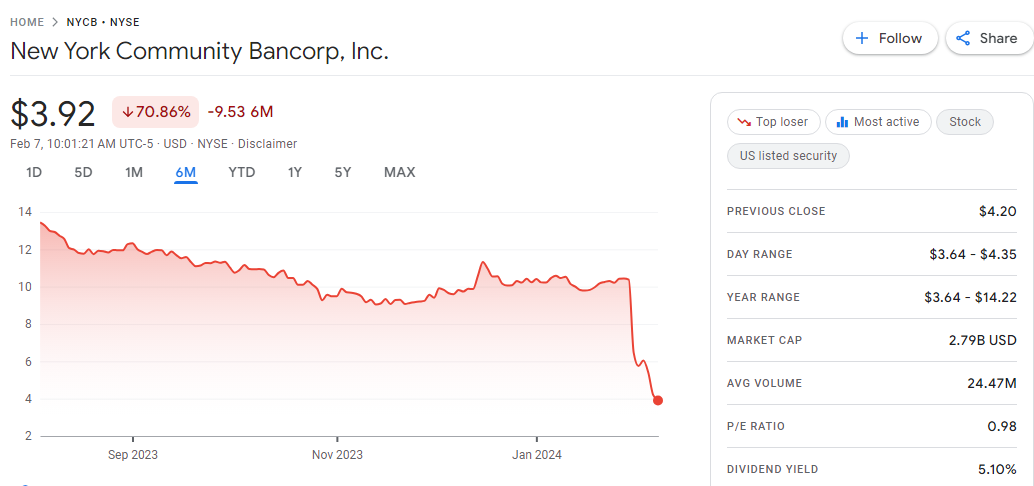

New York Community Bancorp (NYCB) Faces Downgrade In Stock Market1`23 with economic challenges as Moody’s Investors Service downgraded its debt to junk reputation past due Tuesday. Despite this setback, NYCB inventory saw a shocking 12% upward thrust in premarket trading on Wednesday, attaining $4.71.

This uptick observed a great 22% drop in Tuesday’s session, bringing the inventory to its lowest factor due to the fact 1997. The financial institution’s latest struggles can be traced back to its income file, in which NYCB suggested wider-than-predicted loan losses and a dividend cut.

Roots of the Problem: Commercial Real Estate Loans

NYCB’s problems originate from its involvement in business real property loans, a area that has experienced a decline in values over the past years because of accelerated hobby costs. The state of affairs is harking back to the nearby financial institution turmoil witnessed in the preceding 12 months, concerning the fall apart of First Republic Bank, Silicon Valley Bank, and Signature Bank.

Moody’s Multifaceted Downgrade: Financial, Risk-Management, and Governance Challenges

Moody’s downgraded NYCB’s debt by way of two notches to junk, citing multifaceted monetary, hazard-management, and governance demanding situations; dealing with the financial institution. The score business enterprise highlighted concerns about NYCB’s self assurance, specially in its industrial actual estate lending.

The surprising losses from the New York office and multifamily property loans delivered to the challenges faced by way of the bank.

NYCB’s Response and Regulatory Attention

In reaction to the downgrade, NYCB filed a launch with the Securities and Exchange Commission, putting forward adequate liquidity and downplaying the material impact of Moody’s downgrade on contractual preparations.

Treasury Secretary Janet Yellen expressed worries approximately business belongings loans, aligning with NYCB’s challenges. Additionally, the bank confirmed the departure of its leader threat officer, Nicholas Munsun, early this 12 months.

Months ago, we were told that the regional bank crisis is over.

Now, the Regional Bank Index is down 13% YTD with New York Community Bank, $NYCB, down 63% in 1 month.

Here's where it get's interesting, directly from Fed Chair Powell's interview on 60 Minutes this week:

"There… pic.twitter.com/wgDRE4ZwEY

— The Kobeissi Letter (@KobeissiLetter) February 7, 2024

Broader Industry Challenges: Struggling U.S. Banks

Analysts at Gavecal Research noted that NYCB’s struggles may not be isolated, with other smaller funds facing pressure on yields and asset quality.

The SPDR S&P regional treasury ETF rose 0.8% in the pre-sale, outlining companies a wide range of emotions. Valley National Bancorp, Columbia Banking System and Bank OZK also rallied in response to the NYCB stance.

A diversified market: A snapshot of key events

In the wake of New York Community Bancorp’s loan rating downgrade, several other market developments and corporate performance are defining the financial story

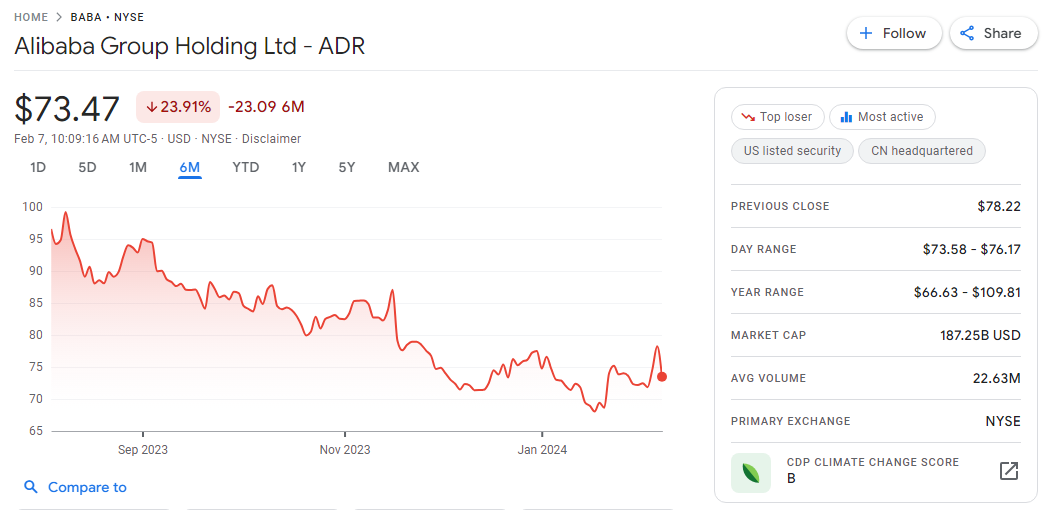

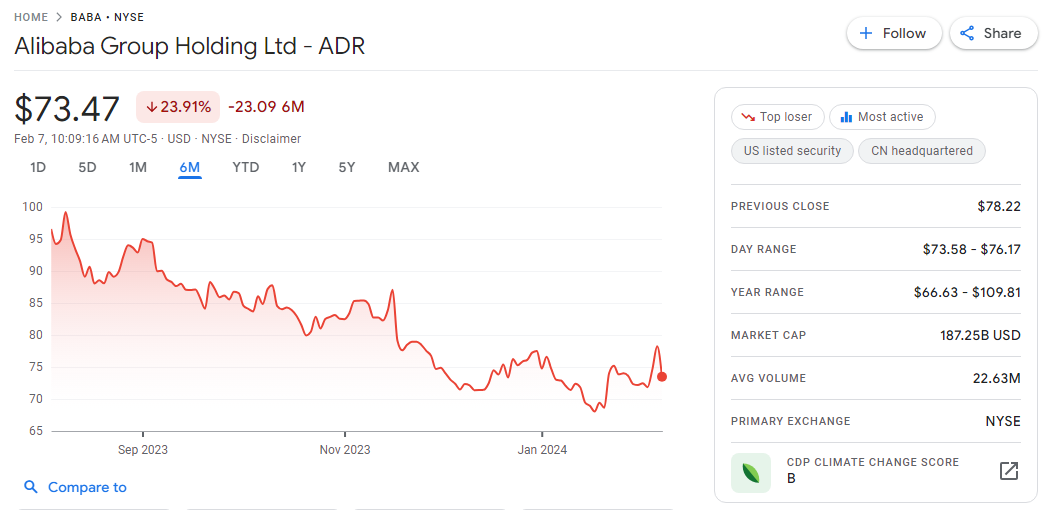

Global Economic Impact: Alibaba’s Quarterly Results

With high volatility in Chinese markets, all eyes are on Alibaba’s upcoming quarterly results. The unveiling of e-commerce and cloud-computing giants can provide insight into the broader global economic landscape.

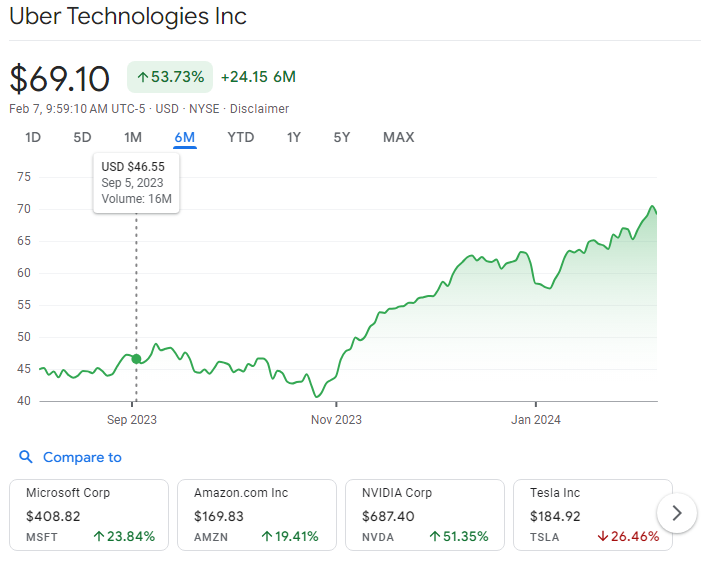

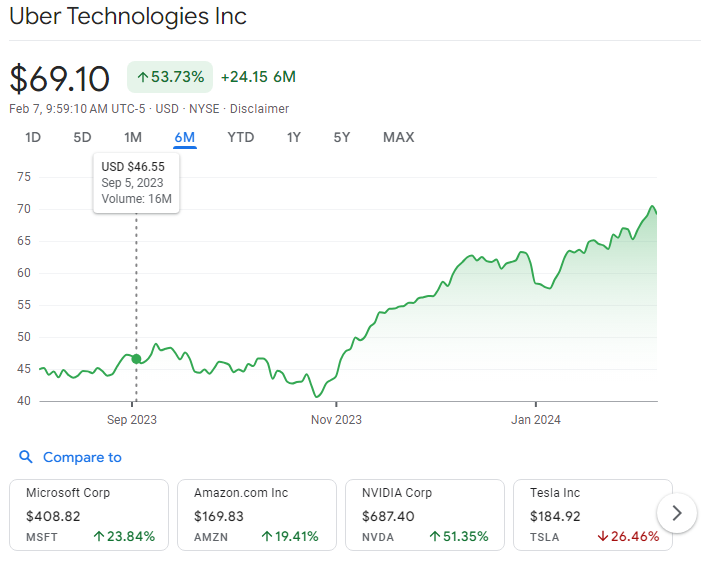

Tech Giants Thrive: Uber Q4 Strong Money

Uber Technologies outperformed expectations with strong fourth-quarter earnings, posting a 22% increase in total orders. The resilience of this great technology stands out in the current market environment.

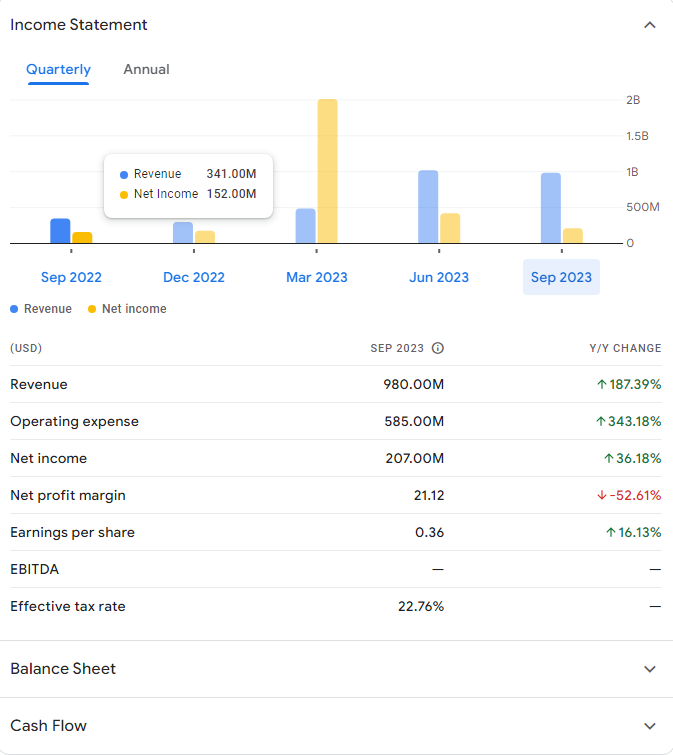

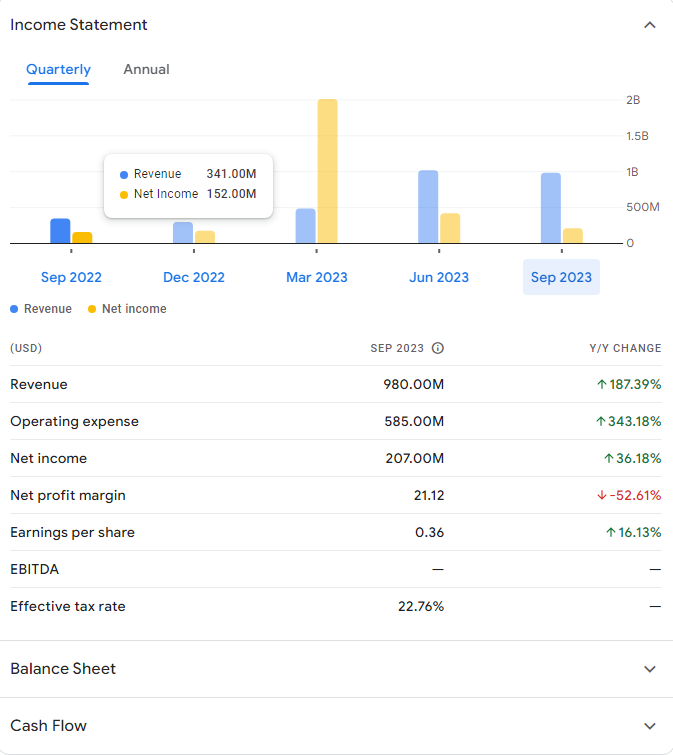

Source: Google Finance.

AI revolution in India: Microsoft training program

Microsoft’s commitment to train 200,000 individuals in artificial intelligence (AI) in India by 2025 signals a broader industry shift towards AI adoption This initiative underlines the company’s focus on technological advancement.

Market trends depend on earnings reports

Optimism has surrounded earnings reports from major players like Walt Disney, Uber Technologies, CVS Health, and more. These reports are poised to influence market trends and investor sentiment.

Automotive Resurgence: Ford’s Positive Outlook

Ford Motor’s high quality fourth-quarter adjusted income and the expectancy of generating an operating profit of $10 billion to $12 billion in 2024 spotlight a ability resurgence within the car zone.

Social Media Setback: Snap’s Significant Decline

Social media enterprise Snap confronted a big decline of 31% following fourth-quarter sales under Wall Street estimates. The setback emphasizes the challenges inside the social media landscape.

Mixed Bag for Clean Energy: Enphase Energy’s Report

Enphase Energy stated combined fourth-area outcomes, with adjusted profits slightly underneath expectations. However, the enterprise witnessed a upward push in inventory price, showcasing the numerous performance in the smooth strength sector.

Cybersecurity Soars: Fortinet’s Impressive Surge

Fortinet experienced an 8.3% surge after surpassing estimates in fourth-zone adjusted income and revenue. The cybersecurity corporation’s strong performance aligns with the developing significance of digital safety.

Audio Innovation Triumphs: Sonos’s Profit Surge

Sonos noticed an 8.1% increase after reporting a higher first-sector profit as compared to the previous yr. The fantastic final results reflects the corporation’s success within the aggressive audio era zone.

The tricky web of marketplace activities, corporate income, and enterprise dynamics is contributing to a multifaceted monetary landscape with both demanding situations and possibilities.

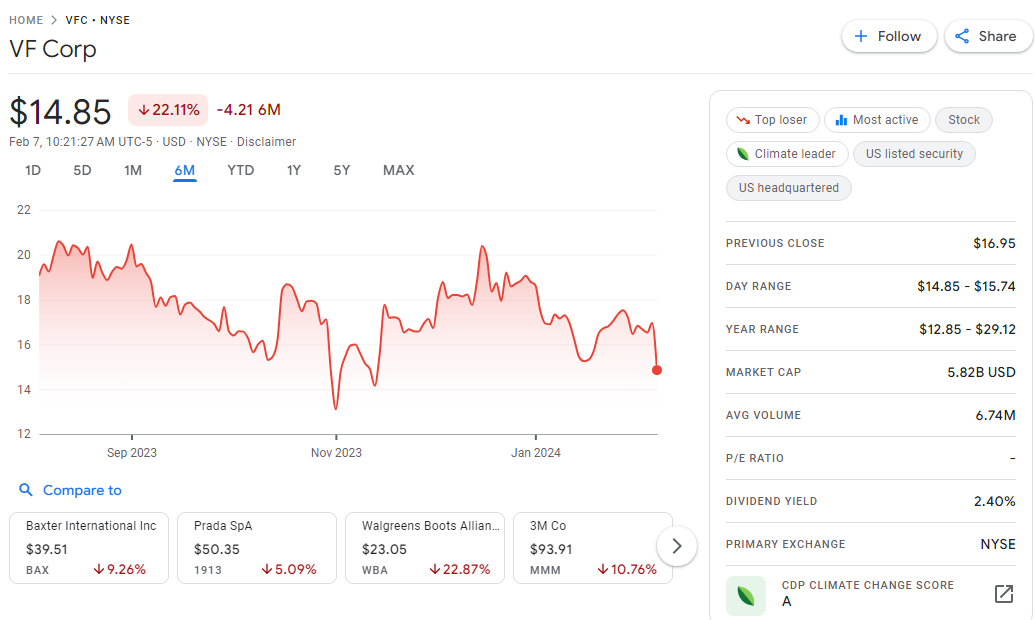

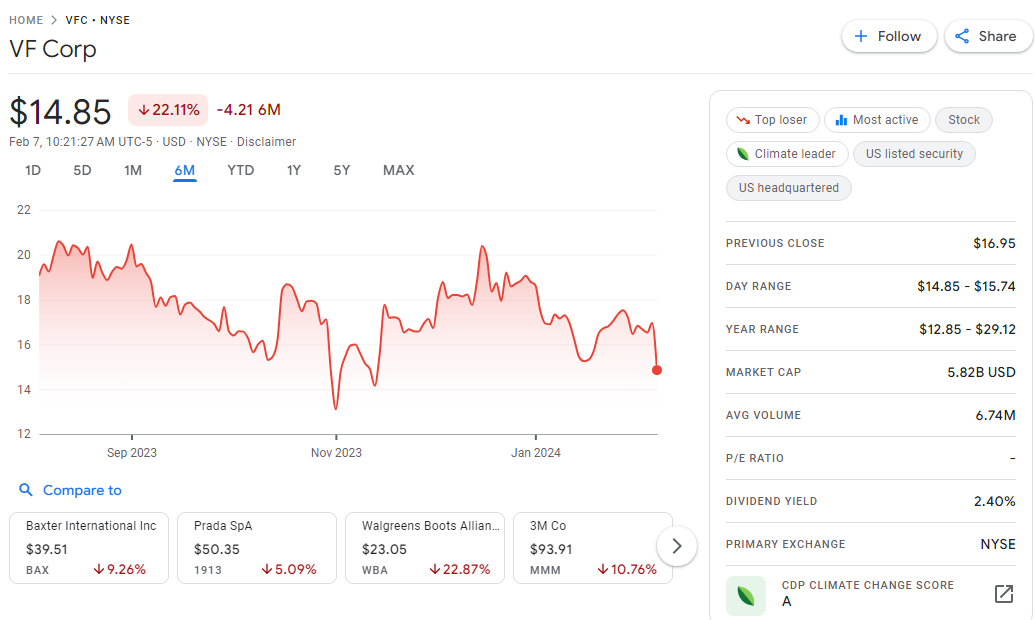

Market Oscillations: VF Corp., Chipotle, and NYCB’s Financial Trajectories

The market’s latest moves have showcased a spectrum of performances, with a few agencies going through challenges at the same time as others thrive.

VF Corp.'s Q3 results fall short; Stock downgraded at Goldman https://t.co/cIMrESJ6CC Follow for more #news #Breaking #StockMarketNews pic.twitter.com/SLbsmluKac

— ProfitTradingUSA (@ProfitTradingUS) February 7, 2024

VF Corp.’s Stumble: A 7.8% Decline

VF Corp. Encountered a setback, with a 7.8% drop in its inventory cost after reporting financial 0.33-quarter outcomes that fell quick of Wall Street estimates. The decline underscores the volatility inside the retail quarter and the effect of monetary uncertainties.

Chipotle’s Triumph: A 2.4% Surge

In evaluation, Chipotle Mexican Grill defied expectancies, reporting fourth-zone results that handed forecasts. This fantastic outcome translated right into a 2.4% rise within the company’s inventory, reflecting resilience and adaptableness in the competitive fast-food industry.

NYCB’s Credit Rating Plunge: A 10% Fall

New York Community Bancorp (NYCB) faced a giant blow as Moody’s Investors Service downgraded its credit rating through notches to junk reputation. This resulted in a 10% decline in NYCB’s inventory, elevating worries approximately the wider stability of the banking sector.

Awaiting Corporate Revelations: Upcoming Earnings Reports

The monetary panorama stays in flux because the market eagerly awaits income reviews from prominent entities together with Alibaba, Walt Disney, Uber Technologies, CVS Health, Arm Holdings, PayPal Holdings, Roblox, Wynn Resorts, and Mattel. These revelations are poised to steer investor sentiment and market developments.

Disney‘s Sports Streaming Venture: A Collaborative Initiative

Disney, Fox Corp., and Warner Bros. Discovery made headlines with their joint challenge to create a sports streaming platform. Encompassing numerous professional and university sports activities, this collaboration adds a brand new dimension to the streaming panorama and reflects the continuing evolution of amusement consumption.

Navigating Economic Uncertainties: NYCB’s Downgrade as a Cautionary Tale

NYCB’s recent credit score rating downgrade serves as a cautionary tale inside the banking sector. As economic uncertainties persist, economic institutions face multiplied scrutiny, emphasizing the want for resilience and strategic decision-making.

In this dynamic financial surroundings, groups navigate challenges and opportunities, with every earnings report and strategic circulate shaping the tricky tapestry of the marketplace. Investors remain vigilant, responding to the nuanced narratives unfolding throughout various industries.

Frequently Asked Questions (FAQs)

1. What brought about New York Community Bancorp’s (NYCB) latest challenges?

NYCB confronted financial challenges following Moody’s downgrade to junk popularity. The financial institution’s stock plummeted 22% after wider-than-expected loan losses and a dividend reduce in its current income report.

2. Why did Moody’s downgrade NYCB’s debt?

Moody’s cited multifaceted financial, risk-control, and governance challenges as motives for downgrading NYCB’s debt. Concerns included self belief troubles, specially in commercial real estate lending, and surprising losses from the New York workplace and multifamily property loans.

3. How did NYCB respond to Moody’s downgrade?

NYCB filed a release with the Securities and Exchange Commission, putting forward ample liquidity and downplaying the material effect of Moody’s downgrade on contractual arrangements.

4. What are the roots of NYCB’s issues inside the industrial actual property quarter?

NYCB’s difficulties stem from its involvement in commercial real property loans, where values have declined during the last years because of expanded interest costs.

5. How did the marketplace react to NYCB’s scenario?

Despite the downgrade, NYCB’s inventory relatively rose 12% in premarket buying and selling on Wednesday, following a big 22% drop in the previous session.

6. What further company challenges does NYCB’s failing imply?

Analysts believe that problems of NYCB maybe not unique and the other small banks are also going through a squeeze in their profitability as well as asset quality. The SPDR S&P regional banking ETF which posted a gain of 0.8% represents the overall feeling within the industry as well.

7. What market-changing future events can be anticipated?

The events that would be earmarked are the Q2 results of Alibaba in Chinese market turbulence, strong revenue growth registered by Uber Technologies during its Q4 earnings period last year; Microsoft’s AI training project in India and reports from such companies as Walt Disney due to release production numbers for this marched preparedness.

8. How did other companies fare in the face of NYCB’s woes?

VF Corp. had a 6 % decline, Chipotle was up by 2%, and NYCB fell down ten for Moody’s Downgrade in the last one year period. Earnings filings from the firms all over the various industries included high to economic performers for instance, Uber and Sonos.

9. What is Disney’s sports streaming venture?

Disney, Fox Corp., and Warner Bros. Discovery forged a partnership to establish a sports-streaming service spanning across multiple professional and collegiate athletic organizations. This venture creates a third axis in the streaming continents.

10. How does the market cope with uncertainty of economy as highlighted by NYCB’s downgrade?

The downgrade of the NYCB credit rating is a lesson within this banking industry and due to uncertainties surrounding its economy, resilience could come top most decision in difficult economic conditions.