Feeling the Market Pulse

In the vibrant realm of the stock market, a lesser-known player, Rambus Inc NASDAQ: RMBS, has recently stepped into the spotlight with a noteworthy surge on the NASDAQGS. While the market chatter revolves around this uptick, the fundamental question remains, does the current valuation truly capture the essence of Rambus’s worth, and could there be an undiscovered gem in the midst of it all?

A Peek into Rambus’s Valuation Dance

Navigating the Valuation Seascape

Our journey kicks off with a peek at Rambus’s price multiple model—a compass that compares the company’s price-to-earnings ratio against the industry average. Think of it as gauging whether the ticket you hold aligns with the earnings the company brings to the table. For Rambus, the narrative skews toward equilibrium. With a price-to-earnings (PE) ratio of 23.4x, it harmonizes with its industry counterparts. This suggests that, at the current market entry fee, you’re likely securing a sensible valuation.

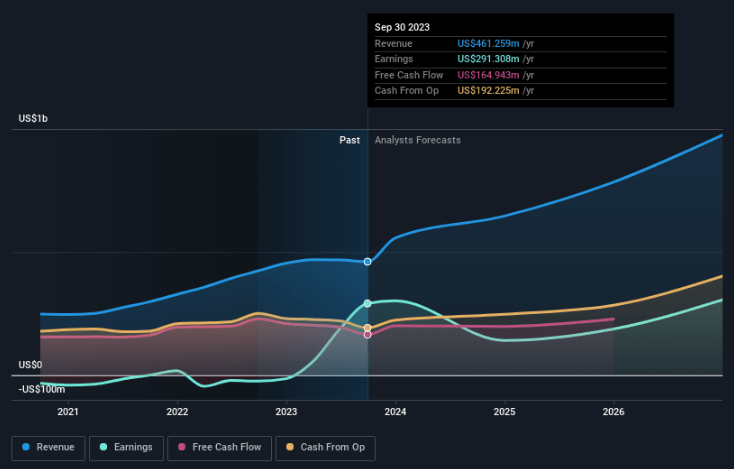

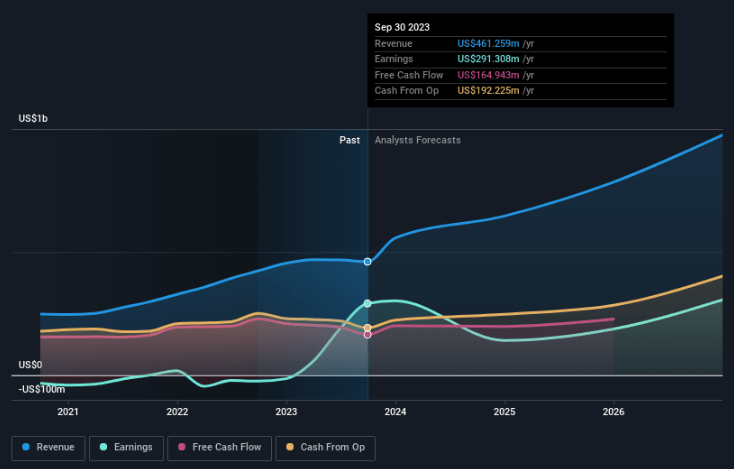

Gazing into the Crystal Ball of Future Growth

Navigating the Road Ahead

Investors, akin to adventurers seeking hidden treasures, yearn for growth in the vast expanse of the stock market. They seek companies that not only promise potential but also come at a price that doesn’t break the bank. Now, here’s where Rambus introduces a captivating twist. The storyline hints at a negative profit growth of -5.1% in the upcoming chapters. This injects an element of caution—short-term gains might not be the hero in this tale. The risk-return balance sways, signaling a journey through higher-risk terrain.

Decoding the Implications for Stakeholders

For the Trailblazers Holding the Torch

If you’re already part of the RMBS adventure, the current landscape feels familiar, aligning with industry peers. Yet, the compass wavers with uncertainty, pointing to negative returns down the path. Could this be the opportune moment to reevaluate your portfolio map? Take a moment to weigh the risks and ensure your exposure aligns with your overall strategy.

For the Potential Pioneers Charting the Course

For those observing RMBS from a distance, proceed with caution. While the stock currently dances with industry price multiples, the clouds of negative growth cast shadows. The potential benefits of any mispricing might be dimmed by the looming risk. Consider all factors in this dynamic landscape, especially those that might shape your decision.

A Cautionary Note in the Adventure

Navigating the Uncharted Territory

Every adventure carries its share of challenges. Rambus is no exception, revealing three cautionary signs in our analysis. A prudent adventurer acknowledges the risks before venturing forth. Thorough research becomes the guiding star in this unfolding journey.

In the dynamic tapestry of the stock market, stories weave together, and each investor adds a unique thread to the narrative. As the plot thickens, thoughtful evaluation and watchfulness become the North Star for those seeking the optimal investment storyline.