Uranium: World’s Largest Miner Faces Supply Crisis Amidst Blistering Price Rally

The uranium market is encountering an exceptional flood in costs, with signals showing that this rally might broaden further. The impetus for this exceptional vertical pattern originates from alerts given by Kazatomprom, the world’s driving uranium maker, about potential stock setbacks throughout the following two years.

Kazatomprom, a heavyweight liable for more than 20% of the world’s uranium yield, unveiled on Friday that its creation for the ongoing year is expected to fall beneath assumptions because of deficiencies of sulfuric corrosive, a fundamental part for removing uranium from minerals. Furthermore, the organization communicated worries about possible effects on creation plans for the next year, indicating a far-reaching influence that could stretch out into 2025.

“If limited access to sulfuric acid continues throughout this year, and construction delays persist in 2024, Kazatomprom’s 2025 production plan may also be affected,” the company cautioned in its statement.

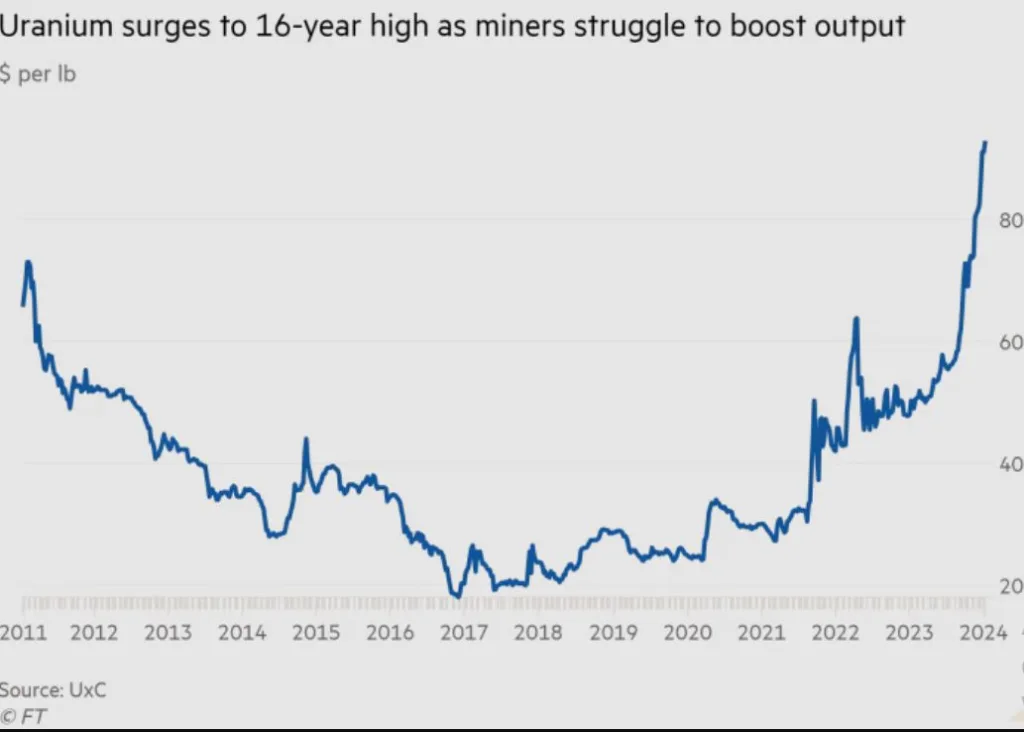

This setback in production for Kazatomprom is magnifying existing concerns in the uranium market, where prices have already more than tripled since the beginning of 2021, reaching a 16-year high. The gravity of the situation was underscored by a trade executed at an impressive $100 per pound on Thursday, as reported by UxC, a leading pricing data provider.

Investors are closely scrutinizing the unfolding scenario, with Robert Crayford, portfolio manager of CQS’s Geiger Counter fund, emphasizing, “The fact that they are dialing back their growth expectations reiterates the expectations for a bullish, tight market. It is a real east vs west for who controls the pounds.”

The flood in uranium costs addresses a huge takeoff from the oversupply conditions that continued for 10 years following the 2011 Fukushima atomic calamity. The ongoing movement is pushed by a worldwide renaissance in low-carbon atomic power, with Western nations broadening the life expectancy of existing atomic plants and effectively putting resources into the development of new reactors.

Of specific note is the UK government’s obligation to extend the atomic limit, adding to the elevated interest in uranium. Be that as it may, the stock difficulties faced by Kazatomprom are worsening the circumstance, raising worries about the likely impact of Russia and China on Kazakhstan’s uranium supplies.

Uranium mining values are encountering an outstanding lift, driven by late ventures from the UK and the US adding up to £300 million and $500 million, individually. These ventures intend to help the development of high-measure low-enhanced uranium fuel, a significant part for little secluded reactors. Regardless of Kazatomprom’s advance notice about gathering its conveyance commitments, the organization stays enduring in its obligation to satisfy authoritative commitments to utilities and different clients all through 2024.

The difficulties faced by the world’s biggest uranium excavator add to a progression of supply disturbances that have added to the flood in spot uranium costs to 15-year highs. With developing interest in atomic fuel and unexpected stock difficulties, the uranium market stays dynamic and ready to proceed with unpredictability, catching the consideration of financial backers and industry eyewitnesses the same.