SEIDA’s Quest for Chip Supremacy in China

Last year, we saw a Silicon Valley veteran, Liguo “Recoo” Zhang, trading his position in the heart of tech innovation for a leadership role in his home country’s budding startup scene. The startup in question? SEIDA, a company based in Hangzhou, China, with big plans to disrupt the microchip design software game. Their pitch? Offering a crucial tool called OPC that’s usually the playground of a few Western giants.

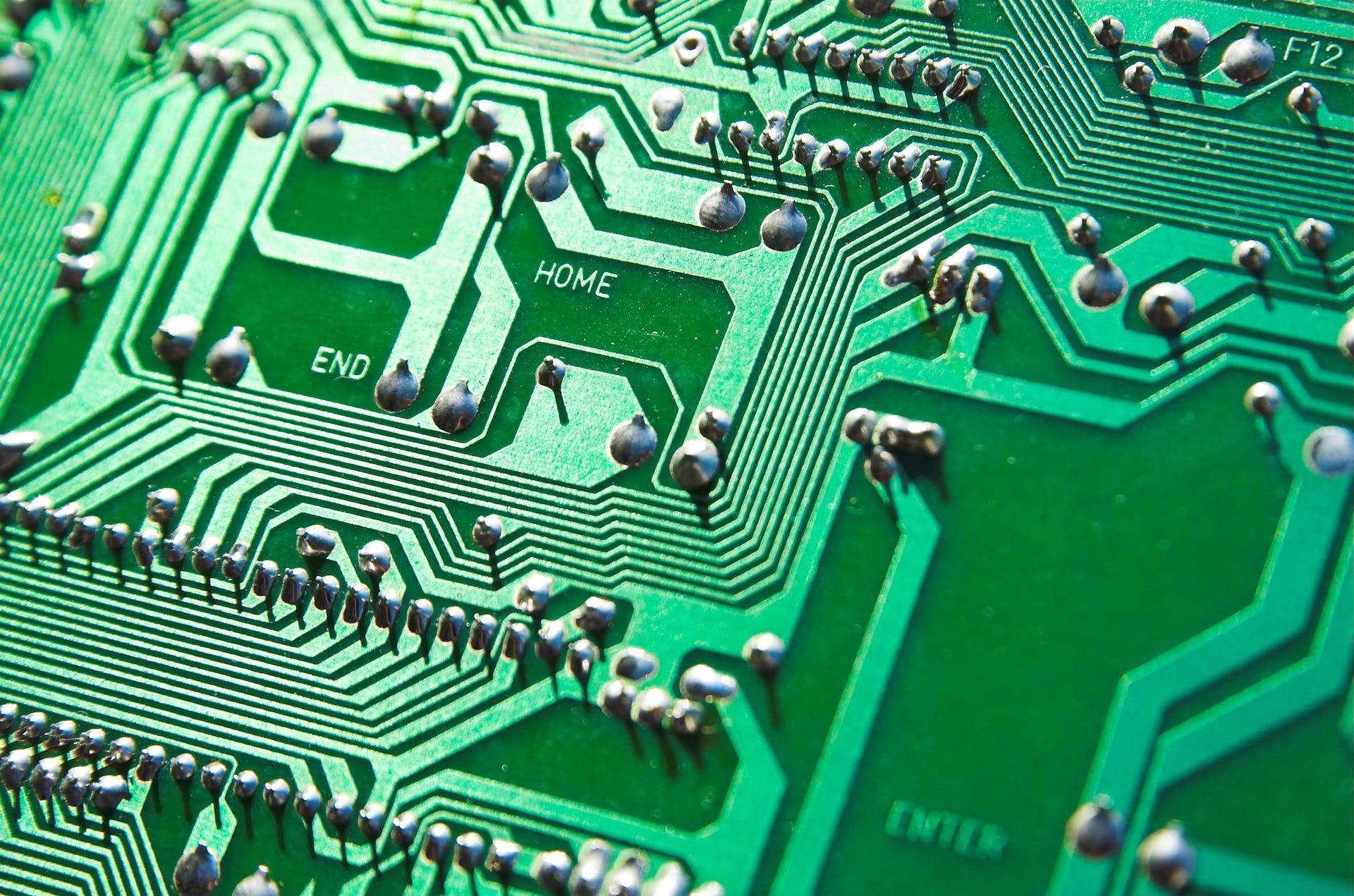

Now, OPC might sound like some secret code, but in the world of microchip design, it’s a big deal. SEIDA believes it’s the key to breaking the foreign monopoly and propelling China into self-reliance in chip technology. Ambitious, right?

Zhang, who once called Silicon Valley home and clocked in time at Siemens EDA, made the jump to SEIDA along with three other Chinese colleagues. Their mission: make OPC a household name in China and, eventually, the world.

SEIDA managed to grab the attention of some heavy-hitting Chinese investors, including Semiconductor Manufacturing International Corp (SMIC), China’s top microchip maker. Now, this is where it gets tricky. SMIC is on Uncle Sam’s watchlist, and U.S. companies need special permission to share their tech with them, all due to alleged military ties.

A recent visit to SEIDA’s Hangzhou headquarters left Reuters struggling to pin down Zhang for an interview. In response to queries, SEIDA’s Chief Operating Officer, Peilun “Allen” Chang, downplayed the earlier prospectus reviewed by Reuters, calling it “obsolete” and highlighting the startup’s evolution and backing from “private institutions and individuals.”

What’s clear is that SEIDA, with its sights set on OPC glory, exemplifies the challenges the West faces in trying to keep China from running ahead in the microchip tech race. U.S. export controls are trying to put the brakes on China’s access to essential tools, but the game is far from over.

Chang, in emails to Reuters, spilled the beans on why Zhang and the gang left Siemens EDA in the first place – blame it on those pesky U.S. restrictions. According to Chang, those restrictions cramped their style at Siemens EDA, limiting their career growth and key project involvement. SEIDA, he insists, is playing by the rules on both sides of the Pacific.

So, is SEIDA on the fast track to becoming an OPC powerhouse? Reuters couldn’t confirm if they’ve made significant strides, but experts in the field suggest it’s no walk in the park to develop OPC from scratch without leaning on existing intellectual property.

The larger story here is about the broader tug-of-war between the U.S. and China in the quest for microchip dominance. Despite Washington‘s efforts to put a leash on China’s tech acquisition, Beijing is all in, throwing big bucks and incentives to lure back its tech talents from around the globe.

While the U.S. throws up hurdles with export controls, it’s unlikely to completely slow China’s roll in chip technology. The game is evolving, and as the race for chip supremacy unfolds, the world watches to see who crosses the finish line first.

- Scientists Reveal the Crystal Structure of Human DNA Frist Time in History of Mankind

- China’s Retirement Age Reform Since1950: Impacts and Implications

- Mystery of Mars’ Spiders: The Startling Phenomenon That Could Change Our Understanding of the Red Planet

- New Mini-Moon Found in Earth’s Orbit “2024-MM”: What It Means for Future Space Exploration

- China’s Mars Sample Return Mission: A Historic Leap for Space Exploration